India’s CPI inflation rockets to a 17-month high of 6.95% in March from 6.07% in February

USDINR 76.096 ▼ 0.08%.

EUR/USD 1.0838 ▲ 0.11%.

GBP/USD 1.3011 ▲ 0.11%.

India 10-Year Bond Yield 7.189% (last close).

US 10-Year Bond Yield 2.746 ▲ 0.70%.

ADXY 106.84 ▲ 0.09%.

Brent Oil 104.44 ▼ 0.19%.

Gold 1,971.10 ▼ 0.25.

NIFTY 17,631.00 ▲ 0.57%.

Global developments

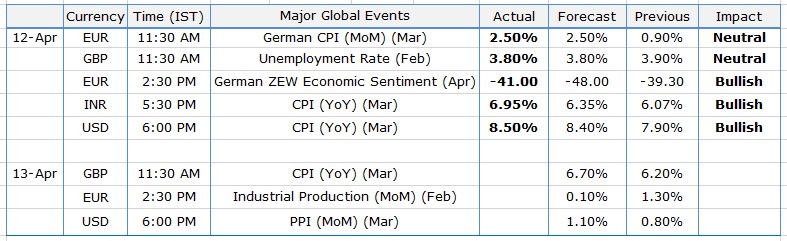

US March headline CPI came in at 8.5% yoy, a 40 year high. Inflation is predominantly driven by soaring fuel and food prices. Core inflation came in a tad lower than expected at 6.5% yoy helped by a fall in the price of used cars. UK March CPI and US March PPI data are due today. US March Retail sales data is due tomorrow. It will be interesting to see what impact higher prices are having on consumption demand. ECB monetary policy is due tomorrow as well.

Price action across assets

US Treasuries saw some short-covering post the CPI print. Yields across the curve are lower by 8-12bps. The Dollar had weakened in a knee-jerk move but has more than recouped its losses. The Euro is precariously close to this year's low of 1.0806 ahead of monetary policy tomorrow. With no immediate de-escalation insight on the Russia-Ukraine front, fears of higher energy prices are causing the Euro to underperform. German 10y bund yields are the highest since 2015. US equities ended with modest cuts with S&P500 and Nasdaq ending 0.3% lower. While Shanghai and HangSeng are trading with minor cuts, other Asian equities are trading with modest gains. Crude prices have inched higher with Brent at USD 105 per barrel.

"UK jobless rate lowest since 2019, but inflation eats into pay."

Domestic developments

India's March headline CPI print came in much higher than expected at 6.95% yoy (exp 6.4%) and above RBI's comfort zone. High rural inflation is concerning. The IIP rose 1.7% yoy in March compared to 1.5% in February.

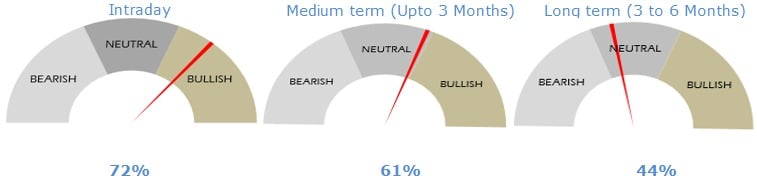

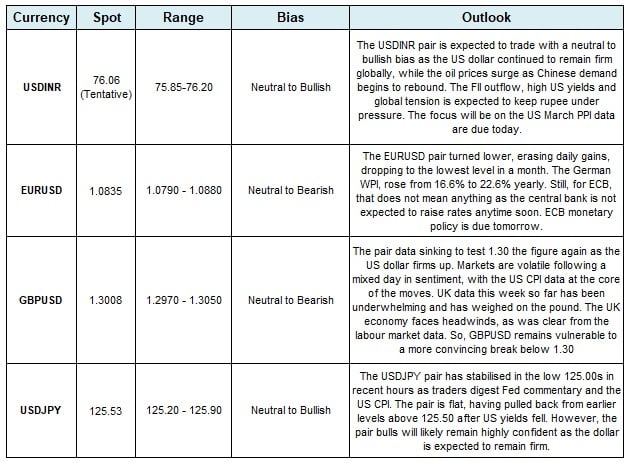

USD/INR

The Rupee weakened yesterday on fix-related Dollar buying. RBI fixing was well bid, trading at a premium of 1p. The rupee ended the session at 76.13. Weakness in domestic equities weighed on the Rupee. The rupee is likely to open around 76.04 and trade in a 75.85-76.20 range intraday with sideways price action.

Bonds and rates

The sell-off in bonds continued yesterday with the yield on benchmark 10y rising 4bps to 7.19%. The higher-than-expected CPI print is likely to result in a capitulation move today. OIS too ended 8-10 bps higher with 3y and 5y OIS ending at 6.10% and 6.50% respectively. 1y T-bill cut-off came in at 4.83% compared to 4.56% in the previous auction.

Equities

The Nifty ended 0.8% lower at 17530. Metals, Oil and gas, and IT stocks dragged the index lower. Broader markets too underperformed.

Strategy

Exporters are advised to cover on upticks towards 76.10. Importers are suggested to cover on dips towards 75.40. The 3M range for USDINR is 74.00–77.00 and the 6M range is 73.80–77.30.

"German ZEW sentiment falls again as war, inflation takes a toll."

FX outlook of the day

"U.S. inflation quickens to 8.5%, ratcheting up pressure on Fed."

Economic calendar

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.