We present a medium-term investment review of the USD/TRY pair.

Since the beginning of this year, the position of the lira has been weakening against the American dollar due to the long-term binding of the asset to a certain range, and there are no signs indicating an imminent change in the trend.

Economic activity in Turkey is declining against the “hawkish” policy of the monetary authorities. Following the last meeting of the Central Bank of the Republic of Turkey, the interest rate was corrected from 45.00% to 50.00%, although analysts were confident that the indicator would remain unchanged. In January, retail sales increased from 1.6% to 2.6% MoM and from 14.05% to 13.3% YoY. However, the rapid inflation prevents the national economy recovery: in March, the consumer price index increased by 3.16% from 4.53% earlier, bringing the rate to 68.50% YoY from 67.07%. The least growth over the year is shown by prices for clothing and footwear ( 50.10%), and the high growth is for education ( 104.7%). Over the month, the only group that showed negative dynamics was drinks and tobacco (–0.02%), and the largest increase was recorded in the education category ( 13.08%).

The American dollar reached 104.50 in USDX, holding above 100.00 for more than four months. At the same time, US Fed officials have not yet begun adjusting monetary policy, while lowering interest rates, according to experts, should support economic growth. According to the Chicago Mercantile Exchange (CME) FedWatch Instrument, the probability of maintaining borrowing costs at the May 1 meeting is 97.1%. At the next meeting on June 12, the possibility of reducing the indicator to 5.00–5.25% is estimated at 61.8%, supporting the American dollar.

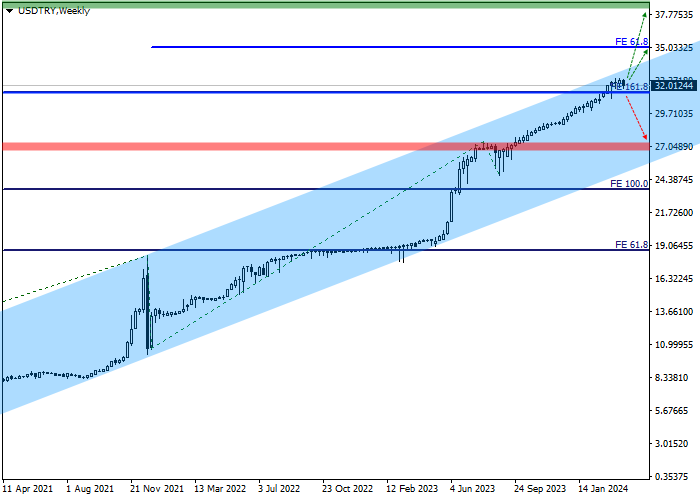

Technical indicators reflect the likelihood of continued growth of a trading instrument. On the weekly chart, the price is moving within the ascending channel 34.5000–26.0000, approaching the resistance line.

The quotes have fulfilled all targets for the trend wave from November 2021, last month consolidating above the target level of 31.5000, the full trend of 161.8% Fibonacci extension, and now they have to work out the fifth wave of the cycle, originating from the correction at the beginning of last summer, with the global target at 41.5000.

Let’s consider the key levels on the daily chart.

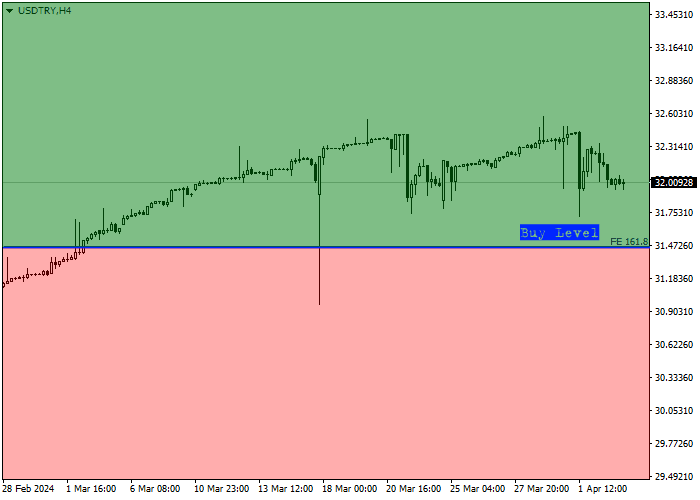

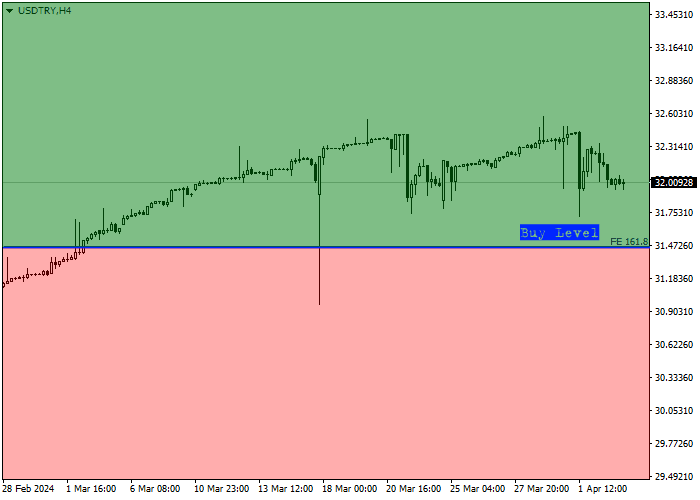

As can be seen on the chart, the current upward wave is holding above the 31.5000 level, the full 161.8% Fibonacci extension trend, reflecting the likelihood of continued growth after the correction is completed.

If the full trend level of 161.8% is overcome downward and 27.0000 is reached, the upward scenario will be canceled or noticeably postponed, and it is better to liquidate buy positions. Around the level of 35.1000, the initial trend of 61.8% Fibonacci extension, there is the first target zone. When the price reaches it, it is better to partially or fully take profits on open buy positions. The second zone is around 41.6000, the basic trend of 100.0% according to the Fibonacci extension, but will become active only after consolidation of the quotes around the first target.

Let’s consider the entry levels on the four-hour chart.

The entry level for buy positions is at 31.5000, the full 161.8% Fibonacci extension trend, which the price has already passed: a signal to enter the market has been received, and buy positions can be formed at the current price.

Considering the average daily volatility of a trading instrument over the last month, which is 439.0 points, the movement to the first target zone of 35.1000 may take 65 trading sessions. However, if a large volume enters the market, the time may be reduced to 48 days.

Hot

No comment on record. Start new comment.